- What Kinds of Properties Are Most at Risk?

- Climate Risk and Insurance: What Buyers Need to Know

- How Climate Risks Affect Property Values

- What Agents Should Do When Advising Clients

- Tools for Navigating Climate Change and Real Estate

- The Rise of Climate Migration and Relocation Trends

- How FastExpert Agents Can Offer Value in High-Risk Markets

The Impact of Real Estate and Climate Change: Risks and Opportunities

Climate change is no longer a future concern. More people than ever are concerned about the effects of climate change and are seeing them directly in their daily lives. According to Gallup, 61% of Americans say they are worried about climate change, while 45% believe global warming will pose a serious threat in their lifetimes.

The changing environment will also have a direct effect on real estate. Research shows that by 2055, 84% of all homes in the United States will see some drop in value because of climate threats. This adds up to $1.5 trillion in lost value.

In a closer window, the same report found that in the next five years, 20% of homes will see a drop in value because of climate change.

Climate change affects property values in several ways. It makes certain homes riskier than others while driving up insurance costs. Some homeowners are taking steps to future-proof their homes against environmental risks, while others are becoming sellers and seeking safer alternatives.

Use this guide to explore the relationship between real estate and climate change. There are opportunities for agents who live in high-risk areas, regardless of whether they are working with buyers or sellers. What is most important is that everyone is informed throughout the process. Here’s what you need to know as more communities than ever face climate risks.

What Kinds of Properties Are Most at Risk?

Every region has different extreme weather events, which means homeowners prepare in different ways. While residents in Florida and Louisiana prepare for hurricane events and enhanced flood risks, homeowners in the West worry about wildfires and extreme heat.

Buyers who move to new parts of the country need to be aware of what various natural disasters could affect them. This will help them understand the types of protections they need for their home, both in terms of insurance and physical improvements.

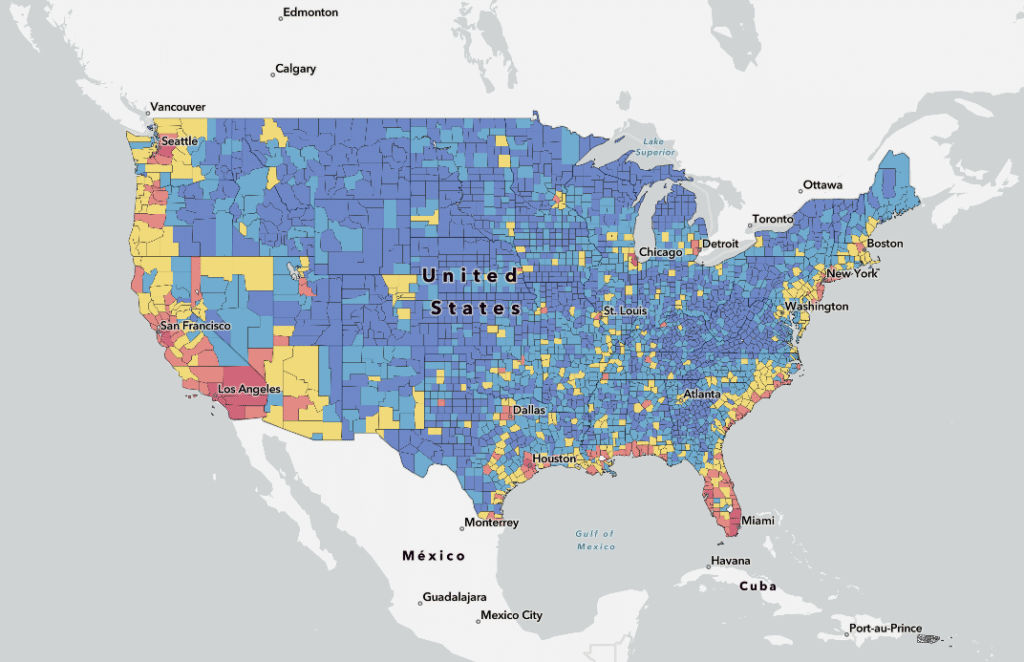

A good place to start is the FEMA Risk Index. This map shows which areas are most at risk for potential natural disasters and how resilient they might be in the wake of an impact. Once you have a high-level view of potential threats, you can explore the likelihood of specific concerns in your target real estate market.

Image credit: FEMA

Here is an overview of a few common threats affecting properties in the United States.

Wildfire Zones

Residents in the Western United States are most likely to live in wildfire zone properties, but at-risk communities expand farther across the country than most people expect. FEMA also publishes a Wildfire Risk Index with data at the county level. Residents in California, Utah, Arizona, and Idaho are significantly at risk.

In some areas, the risk of property damage is low because the population is small. Wyoming and South Dakota are both high-risk states, but they have some of the smallest populations in the country. Conversely, Los Angeles continues to build new housing units to meet resident demand, increasing the number of affected families with each fire. For example, in 1990, there were 3.7 million California housing units in wildfire-prone areas. That jumped to 5.1 million by 2020 (a 40% increase)

Along with fire, more people need to contend with smoke. The haze from wildfires can spread across countries and even continents. For a clear map, AirNow showcases where wildfire smoke makes it hard to breathe. A greater risk of smoky conditions can lead more people to invest in indoor air filters and purifiers for their homes. However, it can also affect the desirability of certain areas. No one wants to live in a place where it’s unsafe to breathe outside.

Flood Zones and Coastal Areas

Water is one of the biggest threats to any home. FEMA reports that one inch of water in a home can turn into $25,000 in damage. Not only do homeowners need to replace the furniture and flooring, but they also may need to replace the drywall.

Before buying a home, it’s important to check the FEMA Flood Map to see the potential risks of a specific address. The post on the Multiple Listing Service (MLS) should also state if interested parties are buying a home in a flood zone.

While buying flood zone real estate can provide opportunities for affordability, it also comes with other financial requirements. Your lender may require you to carry flood insurance to approve the loan. Buyers also need to make sure they can handle the emotional toll that flooding takes on a family. Not everyone can evacuate easily or handle losing all of their possessions.

Climate change experts believe more homes will be at risk of flooding in the future. Even if you aren’t in a flood zone, you may want to carry this insurance coverage if you live anywhere near water. Extreme weather can turn even small streams into raging rivers within a few hours.

Storm and Hurricane-Prone Markets

Hurricanes are often associated with Southeastern coastal areas like Florida, Louisiana, and South Carolina. However, more states will be affected by hurricanes as their power increases along with their range. FEMA’s Hurricane Index, for example, extends its moderate risk levels up to Massachusetts and Maine.

In most cases, home insurance does not cover flooding. Companies will cover storm damage, but not flood damage. This is why residents of hurricane-prone areas are often encouraged to carry flood insurance even if they aren’t in flood zones.

To emphasize the importance of flood insurance, 99% of homeowners who sustained flooding because of Hurricane Helene did not have flood coverage.

When buyers cannot get insurance, they have to pull out of deals or self-insure their properties, which most lenders do not allow. Property values in areas prone to hurricanes and flooding are significantly at risk. Not only do the buyers have to worry about storm damage to their properties, but they have to consider the monthly costs of higher insurance premiums.

Florida is a great example of climate change affecting real estate and home insurance to the point where some people call it an insurance crisis. Annual premiums cost an average of $5,500 across the state, and there are counties where more than 20% of homeowners are uninsured.

Climate Risk and Insurance: What Buyers Need to Know

As climate change risks increase in certain areas, it becomes harder to secure home insurance. Knowing the extreme weather events in your desired area can help you estimate how insurance will be affected and if there will be any challenges in securing it. This can also affect how you search for a home.

Here are a few things to consider as you look to purchase real estate assets and search for insurance.

Key Insurance Challenges

Learn about insurance in any community you intend to buy in. Research average premiums for the neighborhoods and home sizes you are interested in. If this is your first time living in an area with extreme weather, the premiums and coverage limitations might surprise you.

When you find a property, shop around for insurance. Contact multiple companies and compare both quotes and coverage. Just because one insurer offers a good deal doesn’t mean you will be protected in a storm.

As a buyer, don’t forget to factor insurance costs into your mortgage calculations. If you set a hard budget of $1,500 per month, but your insurance premiums push you to $1,600, you need to consider how comfortable you will be. Future insurance rate hikes could also put pressure on your finances.

Sellers may experience buyer hesitation due to unknown or excessive insurance costs. If you are selling in a high-risk area where securing home insurance is difficult, talk to your real estate agents. They may be able to provide options for buyers or suggest a pricing strategy to make your home appealing despite the insurance costs.

Disclosures and Legal Requirements

Climate risk disclosures are designed to inform buyers that they are purchasing property in areas with extreme weather events. While regulations vary by state, more sellers are required to disclose any known potential risks to buyers.

Some real estate professionals say out-of-area buyers are most at risk of purchasing property without knowing the effects of extreme weather events. For example, a buyer might purchase beachfront property in Florida without considering hurricanes and flooding.

While buyers need to be informed of potential risks in their target real estate market, their agents also need to inform them of what to look for. It is the fiduciary responsibility of Realtors to help clients make sound investments and homeownership decisions.

When sellers and real estate agents are transparent about potential risks, every purchase can be made fairly. As the Los Angeles data shows, there is still a lot of demand for areas affected by climate change. People still want beachfront homes and desirable neighborhoods, and they are willing to take on the risks that come with living there.

Understanding the NFIP and Private Flood Insurance

Buyers looking for flood insurance can go through the National Flood Insurance Program (NFIP) through FEMA or consider private flood providers. FEMA offers different examples of flood insurance costs based on price range and location. Using the data, 37% of policies cost less than $1,000 per year, and 32% cost between $1,000 and $2,000. When estimating costs by replacement value, premiums that cost less than $1,000 have an average value of $400,000.

Your estimated annual bill will depend on your home and your actual flood risk. A larger property might have a smaller flood insurance bill if it is built further inland or on higher ground.

Buyers can shop for insurance options if they want flood coverage. Depending on your loan and where you are buying, your lender might want to review your flood insurance policy as well.

How Climate Risks Affect Property Values

Climate change will have a noticeable impact on home prices in the future and is already starting to impact buyers. One study found that 83% of people planning to look for a new home next year will consider climate risk, with 46% percent saying it is a very important factor. Interestingly, the largest age range concerned about extreme weather was people older than 55. This suggests that older buyers do not want to risk losing their real estate assets.

However, people continue to move to high-risk areas. Between 2020 and 2024, Florida’s population grew by 8.23%, making it the fastest-growing state in the nation. Its property values also grew by $150,000. Texas followed Florida in population growth, with a rate of 7.02% despite its risk of extreme heat.

Some people worry that rising insurance costs and increased extreme weather events in states like Florida will harm housing markets, potentially triggering panic selling if there is fear of a real estate bubble. However, despite the recent hurricanes and higher insurance prices, people continue to move to these areas.

That said, there are some signs that the markets are beginning to cool. According to Zillow, many of the major metro areas of Florida have started to favor buyers. Three of the top 10 coldest markets in the country are in Florida as of February 2025 (and three are in Texas). Bankrate also found that four out of five of the coldest markets in 2025 were in Florida.

This doesn’t signal an outsight housing market collapse, and may be the result of a real estate bubble that formed during the COVID-19 pandemic. Only long-term housing trends can determine whether the markets are the result of climate change or economic factors.

What Agents Should Do When Advising Clients

Agents will have to contend with the perceived climate risks that affect demand by buyers and the marketing strategies of sellers. Even if climate change isn’t directly felt in your area, it could have a potential impact on how you navigate relationships with your clients. Here are a few things to know if you work in the real estate market to help transactions go smoothly.

With Buyers Entering the Real Estate Market

- Help your buyers make informed decisions. Keep local FEMA maps on hand and share risk information with them as they tour different properties and neighborhoods.

- Be objective. Don’t downplay the extreme weather events in your area, but also don’t cause buyers to panic. Let your clients know that extreme weather needs to be taken seriously and that the risks can be managed.

- Help clients with their insurance needs. Guide them to assess insurability and cost before making an offer. Network with insurance agents you can recommend in high-risk areas. This can make the process of protecting the home less stressful.

- Encourage area-specific inspections. Recommend hiring processionals when assessing risk. Flood inspections, wildfire mitigation inspections, and other specialized appointments can help buyers identify areas they want to avoid or sound properties in the storm.

- Discuss long-term marketability and resale challenges. There’s no guarantee that property owners will turn a profit when they sell. If a real estate bubble bursts, especially because of climate change, a buyer might lose money. Consider having honest conversations about demand for homes in the area and the market’s potential response to sea level rise.

With Property Owners Trying to Sell Real Estate

- Disclose clearly and early. Environmental issues like flood risks are often discoverable regardless and hard to hide. Encourage your sellers to discuss the strengths and weaknesses of the property during a climate change event.

- Obtain insurance quotes or coverage history. Ask your sellers to pull this documentation before listing. This can reassure buyers that the home is insurable and provide buyers with estimated costs for coverage. If a buyer knows what they can expect from insurance costs, they can budget better.

- Consider retrofits or mitigation efforts. It’s common for homeowners to make renovations and repairs before listing. Consider recommending upgrades that protect against climate change (storm shutters, raised foundations, better insulation, generators, etc.) while providing a return on investment to sellers.

- Price strategically to reflect market risk. Do not stoop to panic pricing or try to undervalue your client’s property. Instead, consider what the home is worth in the real estate market and what risks buyers take on with the home. A small price adjustment can keep some buyers within their ideal budgets once they account for insurance costs.

Tools for Navigating Climate Change and Real Estate

Real estate agents who are serious about helping buyers and sellers in at-risk areas can save resources and share them when appropriate. Each of these tools can help people make sound decisions, whether they are selling their house in storm surge zones or checking flood insurance rates. Bookmark these pages so you can assist customers when they ask about climate issues.

- FEMA Flood Map Service Center: This is a great starting point to research properties at the county and even the address level. Buyers can learn about risky areas while sellers showcase how safe their homes are.

- Risk Factor by First Street Foundation: These tools provide additional information. The First Street Foundation also frequently publishes insights and reports on climate change.

- ClimateCheck Reports: Learn how climate change will affect specific properties.

- State and Local Government GIS Tools: More communities are investing in technology that makes reporting easier.

- Local Insurance Brokers: Form relationships with people who specialize in covering high-risk zones and bring them into the purchase process early on.

- Specialist inspectors: Find people who specialize in storm surges, flood damage, and other risks. They can confirm that a house is a sound purchase.

- Local contractors: Recommend professionals to sellers who want to invest in upgrades that make their home more desirable, like energy-efficient upgrades and storm windows.

You can’t control housing prices or rising sea levels, but you can be prepared with resources when clients ask for them.

The Rise of Climate Migration and Relocation Trends

Climate migration is the act of moving to a place with fewer weather risks. For example, someone might leave Florida because they no longer want to live in a state that gets hit by hurricanes. As the effects of climate change become more prominent in the coming decades, climate migration will be more common. More people are likely to move because of the weather.

For example, Columbia University found 3.2 million people have moved to escape flood risks in the past 20 years. The American Bar Association estimates that more than 200 million people may be displaced by climate change by 2050. They have found that 21.5 million people have been displaced annually since 2008.

Some people are pre-emptively leaving communities as heat and flood risks increase, while others never return after they evacuate from a disaster. Before Hurricane Katrina, the population of New Orleans was 484,674. By July 2006, the population had dropped to 230,172 – more than half of the city’s population was lost.

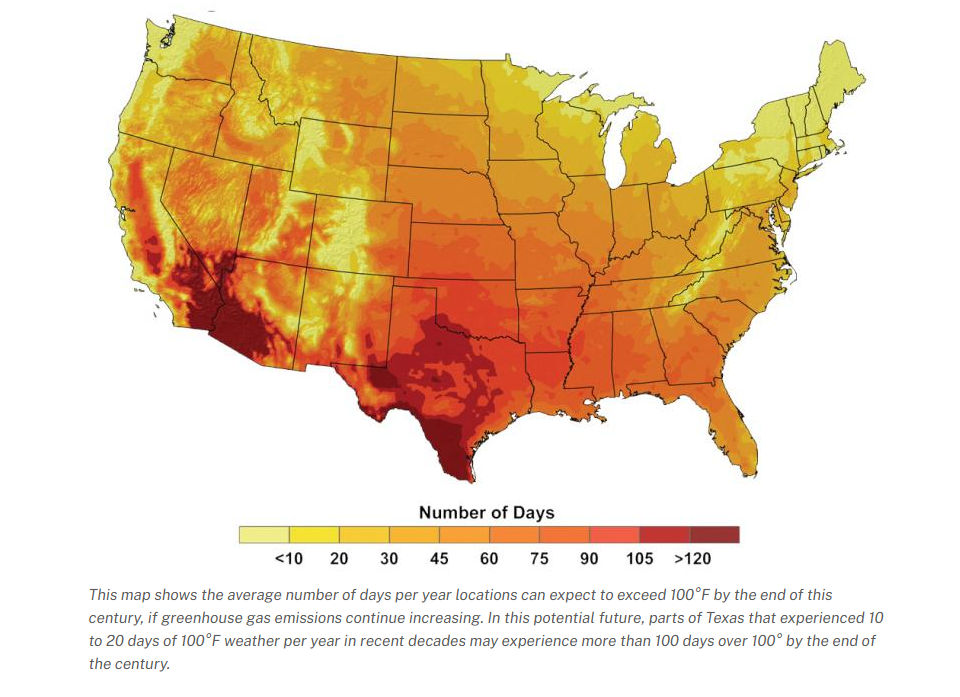

A major disaster doesn’t have to trigger displacement. Some real estate owners are selling because they want to live in more comfortable climates. The government has a map with the number of days per year with extreme heat, with temperatures greater than 100°F. Someone who lives in New Mexico or Texas might consider moving to Wyoming, where it’s much cooler.

Climate change needs to be an honest discussion in real estate markets. Agents need to understand flood risks and other challenges for buyers and sellers. Neglecting these environmental changes is doing a disservice to entire communities, not just individual homeowners.

Image credit: Climate.gov

Agents in Low-Risk Climate Change Regions Can Attract Buyers

The rise of climate migration isn’t bad for everyone. Some communities stand to grow because of their higher elevations, favorable climates, and lack of natural disasters. Agents within these real estate markets can promote the favorable climates to attract clients. They can showcase how homes are more energy efficient because they need air conditioning on fewer days of the year. They can highlight low wildfire risk levels and minimal impact from sea level rise.

Climate change will affect everyone. It’s just that some areas will grow if they are better prepared to make it through difficult environmental conditions.

How FastExpert Agents Can Offer Value in High-Risk Markets

Experienced Realtors will be able to navigate any real estate market, no matter the benefits and risks that come with it. Climate change will affect home prices and buyers, but many of the communities that are currently at risk are still desirable places to live. The key to handling an uncertain future is to stay informed and understand the needs of customers. This is where FastExpert comes in.

FastExpert agents are leaders in their field. They are experienced and have the resources buyers and sellers need to make confident decisions. If you are planning to enter the market in the future, find an agent through FastExpert. You can hire someone who is a good fit to reach your goals.

Agents looking to grow their client base and skills can also use FastExpert. Join a community of growing Realtors who are ready to take their careers to the next level. Let us help you improve your skills so you can provide better experiences to customers.

No one can predict the future, but everyone can take steps to weather the effects of climate change. Good resource partners and clear information can help anyone, no matter their situation. FastExpert can help.