California Housing Market – Trends and Predictions

Click here to browse our Real Estate Agent Directory and contact top-rated agents in your area!

California Housing Market at a Glance

October 2022

California’s median home price has been on a steady decline since April 2022, when median sales prices reached an all time high of $846,200. Over the past 6 months, median sales home prices have dropped $90K to a price of $755,900.

While this is a significant decrease in price, the competitive housing market and strong buyer demand keep home prices in California elevated far above the national median home price of $397,549.

Yet, the California housing market is not immune to stubbornly high inflation and rising mortgage rates. 36.4% of homes that are for sale had a price drop in the past month, an indication that the California housing market is cooling.

“High inflationary pressures will keep mortgage rates elevated, which will reduce buying power and depress housing affordability for prospective buyers in the upcoming year,” says CAR vice president and chief economist Jordan Levine CAR. “As such, housing demand and home prices will soften throughout 2023.”

We’re seeing houses stay on the market longer for an average of 37 days, a 48% increase in time on the market, reflecting a less competitive housing market and perhaps a more favorable market environment for buyers.

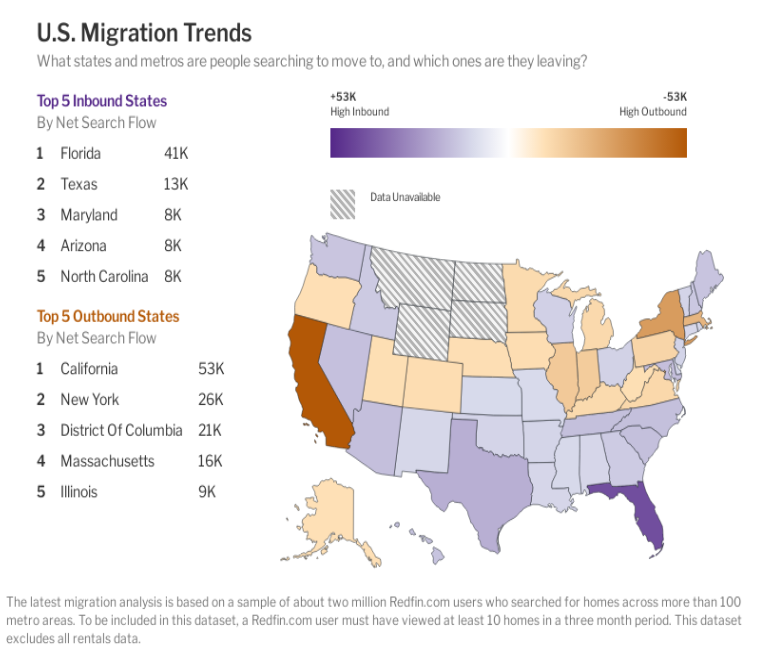

California’s Population Decreases for Second Straight Year

While California maintains its top spot as the most populated state, that status is wavering, as its population decreased for the second straight year.

In addition, California had the biggest population decrease in the Nation.

With the soaring cost of living and remote work options, many are forsaking the Golden State for a more affordable option with a lower median home price. Home sales in neighboring states have grown and we’re seeing the California market shift.

While California will always remain an attractive place to live because of the weather, Hollywood lifestyle, and technology sector, it is feeling the squeeze from the rising interest rates, inflationary pressure, and exodus of people.

With fixed mortgage interest rates at almost 7%, it will reduce homebuyers’ purchasing power and suppress buyer demand.

California’s Largest Metro Areas During the Pandemic

California is a unique state in terms of housing markets. Its sheer size, population, and economic sectors mean it’s challenging to talk about the state as a single market. At any point in the real estate cycle, there will be certain areas experiencing price growth while others are declining.

San Francisco Real Estate Market Trends

San Francisco, known for its incredibly high cost of living, was one of the major metropolitan areas negatively impacted by the pandemic. In fact, you could say that the city experienced a mass exodus of its more transient population. Think of this population sector as your high-income earning, high rent-paying tech employees. With the freedom to now live and work anywhere, many left their cramped, overpriced city homes in search of more space.

Some found that space just across the bay in some of the East Bay Area’s satellite cities like Oakland. While others traveled even further (Texas, Arizona, Washington etc.) to find a new home. However, while regional cities like Stockton, Sacramento, Riverside, and even Truckee saw home values climb throughout the pandemic, San Francisco prices bounced up and down along the same plateau. According to Redfin’s September data, the median sale price in San Francisco is lower today than it was pre-pandemic.

While San Francisco’s city market may not have seen much, if any, price growth due to pandemic stimulus and low interest rates, the surrounding Bay Area cities certainly did. The Bay Area’s housing affordability crisis only deepened over the past few years, much the same as Los Angeles and its surrounding counties.

Los Angeles Real Estate Market Trends

Unlike San Francisco, Los Angeles was sent into a spiraling climb throughout the pandemic. Los Angeles has exceeded New York City, earning the title of the least-affordable housing market in the country. 2021 saw year-on-year growth rates peak at over 20%. As of September, despite high interest rates and a sharp decline in buyer confidence, year-on-year growth still sits at 3.3%.

The current reality for both the Bay Area and Los Angeles markets is that there’s a severe undersupply in housing. Yet, there are still enough buyers in the market who can afford both high sale prices and high interest rates for those homes that are being listed.

Regional California Home Price Growth

California’s smaller cities and even many of its quaint rural towns saw strong price growth over the past few years. Low interest rates and high consumer confidence resulted in bidding wars in markets that have been historically subdued.

California’s strongest real estate markets throughout the pandemic were in areas like San Bernadino, Sonoma, Sacramento, Placer, and San Joaquin counties. These counties are considered rural, with homes offering more space and lower price tags than their city counterparts.

California Housing Market Forecast

Because San Francisco is such a mature real estate market, it will likely not have the same level of decline as cities that became over-valued during the pandemic (think Boise and Phoenix). On the other hand, Los Angeles will likely be more vulnerable to price drops. However currently in LA, homes are still moving quickly.

The California housing markets that are likely to experience the most decline are those that experienced the greatest growth over the past few years. Areas like Sacramento and Stockton are already seeing clear downward trends.

California Home Prices Forecast

On average, the California housing market is predicted to see a continued price decline throughout the end of 2022 and through 2023. According to the California Association of Realtors, the California median home price is forecast to decrease 8.8%.

California Home Sales Forecast

In addition, California single family homes sales are predicted to experience a decline of 7.2%.

With fixed mortgage interest rates rising rapidly, housing affordability has decreased and is contributing to a weaker housing market.

However, each area of the state will respond differently. Homebuyers and investors need to consider local trends with professional guidance.

A Local Real Estate Agent is Your Best Asset

When buying a property in California, a city’s market and even a local neighborhood’s demand will have a massive impact on price and how it will respond to changing economic conditions. Therefore, buyers in California should work closely with an experienced local real estate agent who can guide them through a challenging market.

Are you in need of a California real estate agent? Find a trusted local expert with FastExpert.