Service Areas

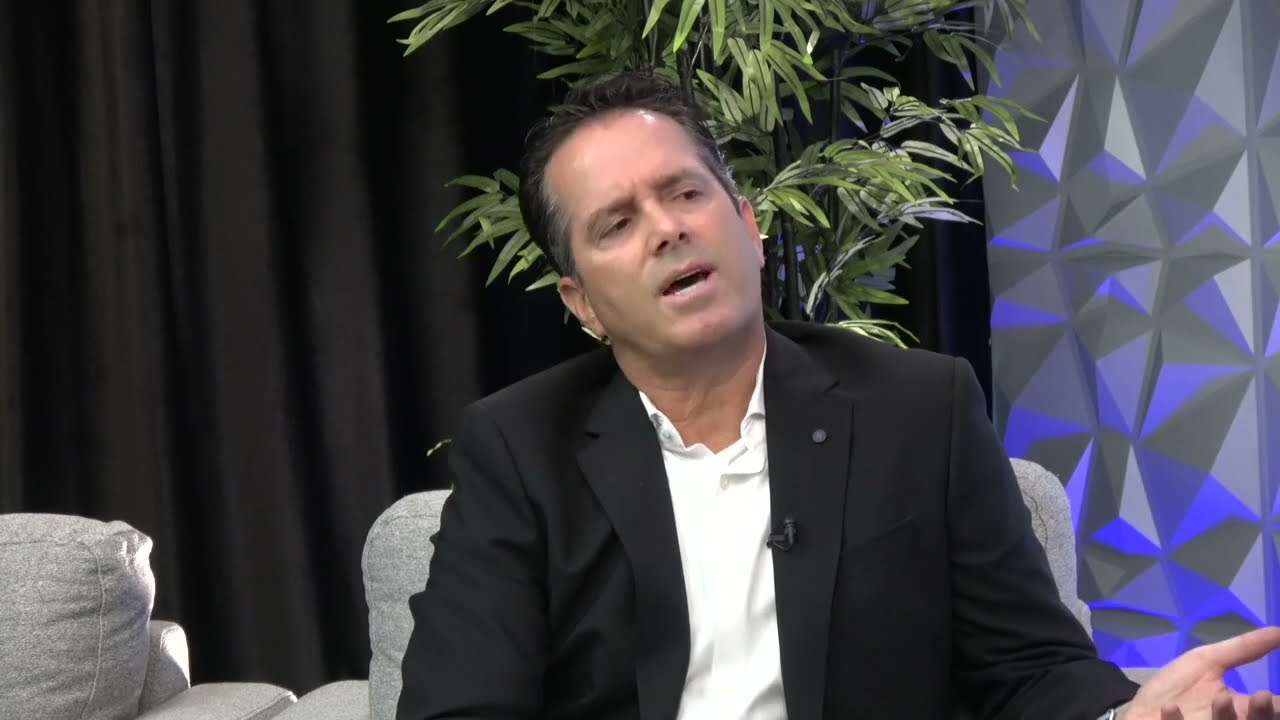

About Chad Basinger REALTOR, CPA, CFP,

OTHER LANGUAGES

Community Involvement

HOBBIES/INTEREST

FAMILY

Credentials

LICENSE

Designation

PSA (Pricing Strategy Advisor)

CRS (Certified Residential Specialist)

SFR (Short Sales & Foreclosure Resource)

ABR (Accredited Buyers Representative)

Seniors Real Estate Specialist

Top Producer

Licensed Realtor

ePro

REALTOR

Specialties

- Buyers

- Sellers

- Residential Property

Luxury Properties, Relocation, Seniors, First Time Homebuyers, Move Up/Move Down Buyers, Divorce Sales

Awards

-

2026

TOP AGENT

Poway, CA

Other Awards

San Diego Association of Realtors Circle of Excellence Award (given out to the top 5% of agents in All of San Diego County)-Every Year Since Inception (2016)...#1 Individual Agent for Windermere Homes & Estates in all of San Diego County in 2020 & 2021......FIVE STAR AGENT AWARD

Answered Questions

Hello Danielle, It is great to see you being proactive and considering tax ramifications. I am a REALTOR, who also has an active CPA license and CFP certificate. When it comes to capital gains taxes and real estate, as long as you have lived there for 2 of the last 5 years, you will be able to take advantage of the $250,000 capital gains exemption amount. In this case, your gains are well below the 250K amount, so would not have any capital gains taxes at this stage. To answer your question regardless of this, the 2 out of 5 year requirement would be met as long as you close on that property in 2027 (specific date depends on when you moved out of it). Good luck!

Hi Linda, Please email me at [email protected] and I will reply with a very insightful, one page consumer guide to buyer broker agreements put out by the National Association of REALTORS. Of course, I am always happy to chat with you on the phone so I can answer any of your questions. I can be reached at 858-997-3704.

Available Listings View All

View All Listings

View All Listings